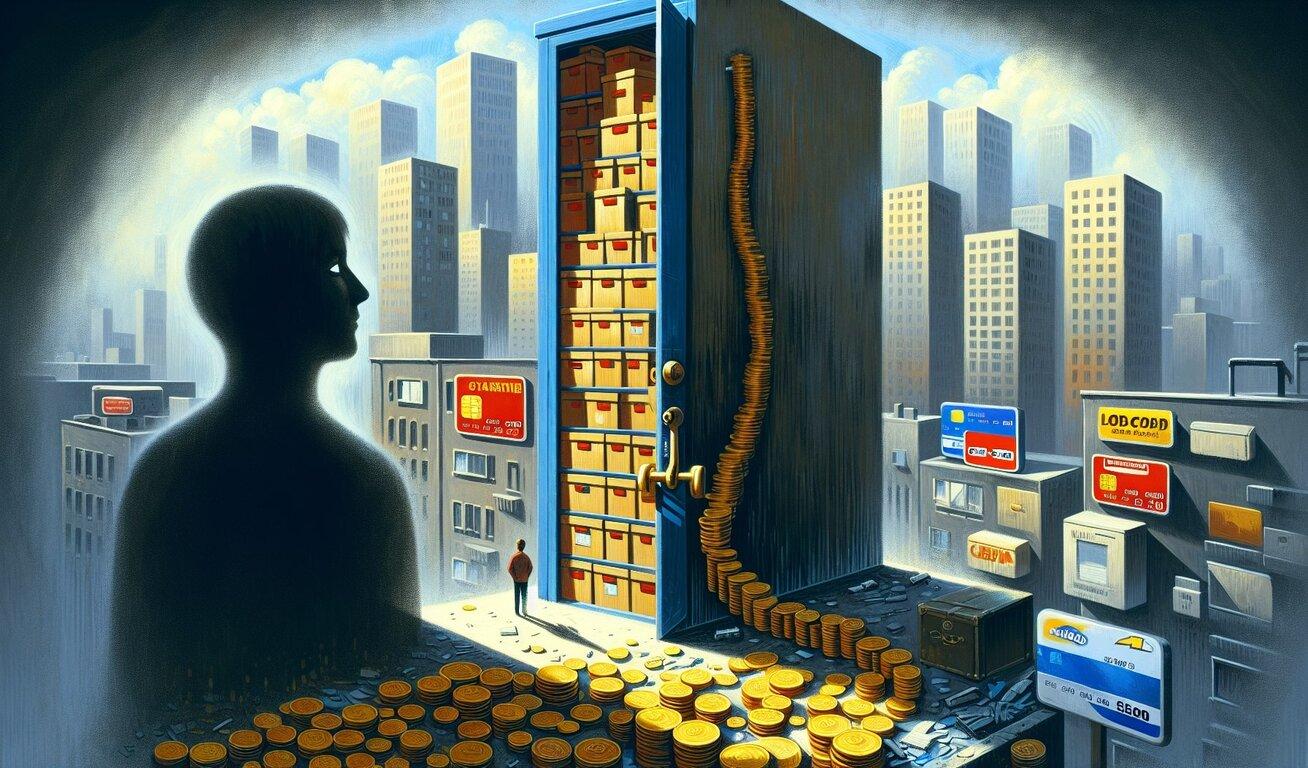

The immediate aftermath of unpaid storage units is quite straightforward and, unfortunately, swift. The storage facility, under the legal right of lien, can hold onto the contents of your storage unit until you settle the outstanding debt.

If you think this is just a temporary lockout, you're in for a surprise. Continuous non-payment could lead to eviction, with you losing rights to the space and the stored items.

Imagine being denied access to your own belongings! It might sound harsh, but it's the reality when you avoid or miss your storage unit payments.

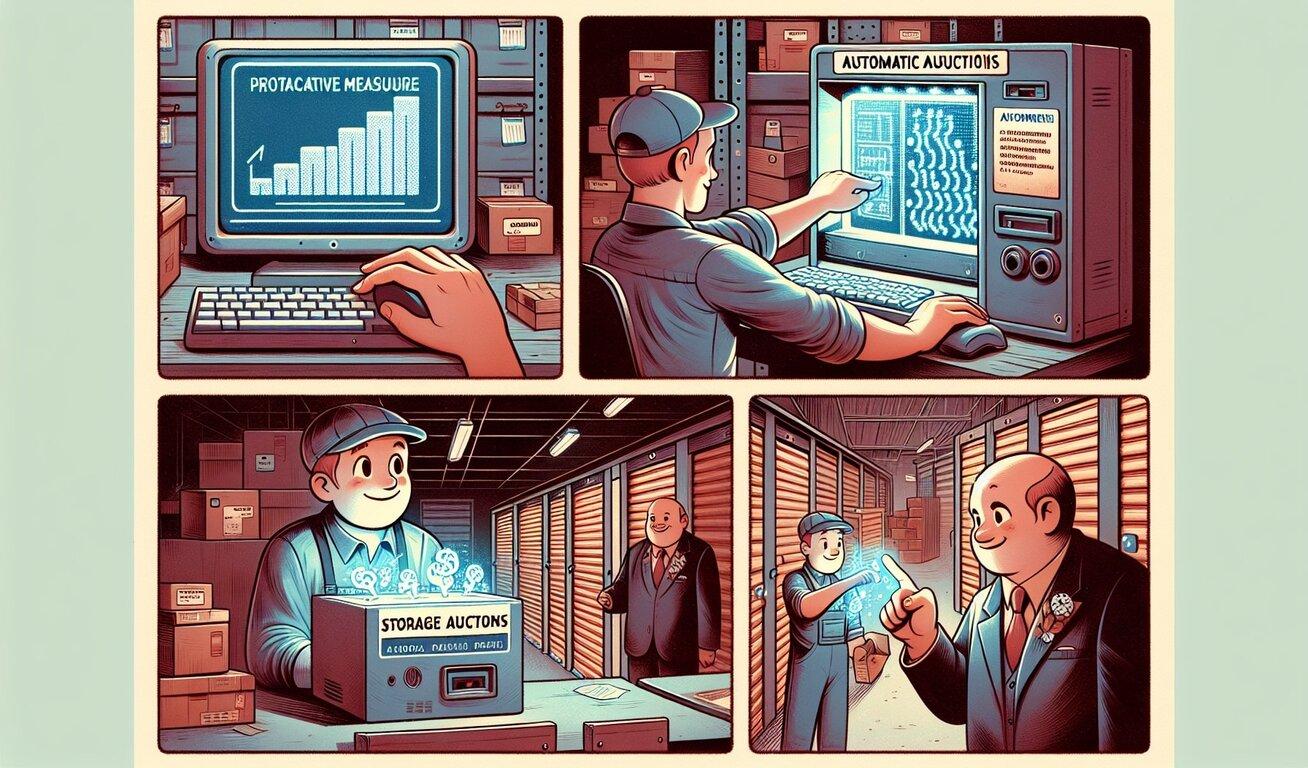

Indeed, storage facilities have the power to auction off your prized possessions to recover the owed amount. These storage unit auctions are legal and part of the storage company's last resort to recoup their losses. However, before reaching this point, there are other immediate consequences you should be aware of.